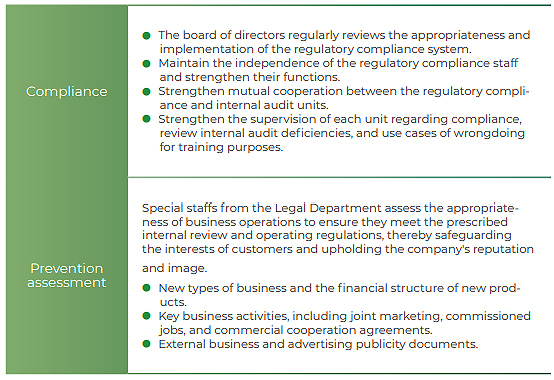

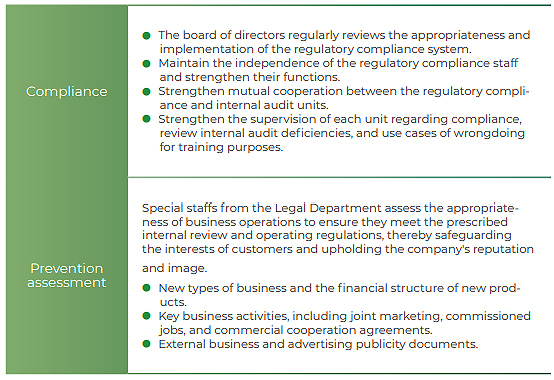

When Chailease Holding went public in 2011, it voluntarily raised its regulatory compliance standards. Just like financial institutions, it established special business units to develop regulatory compliance management practices. Other major subsidiaries, including Chailease Finance Co., Ltd. and Chailease International Finance Corporation, also developed regulatory compliance management practices. They regularly hold regulatory compliance training and awareness programs to ensure their operations and products comply with internal and external regulations. In addition, they conduct annual internal regulatory compliance inspections and report the results to the board of directors.

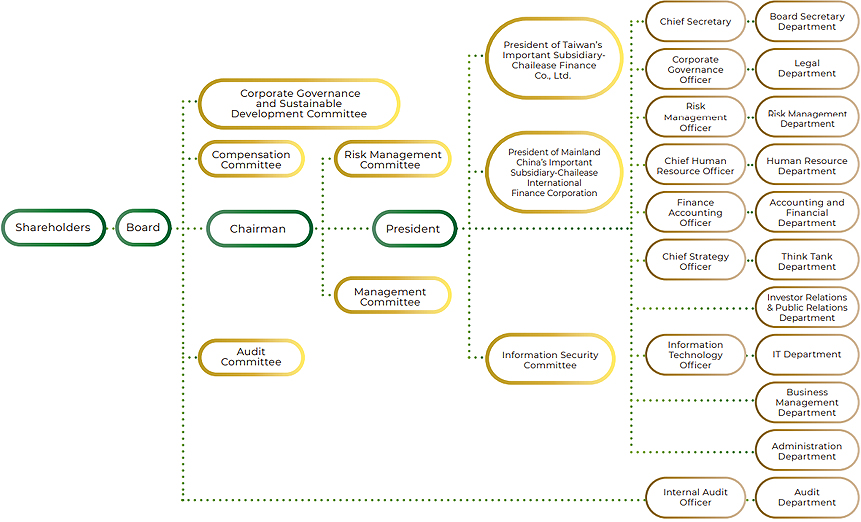

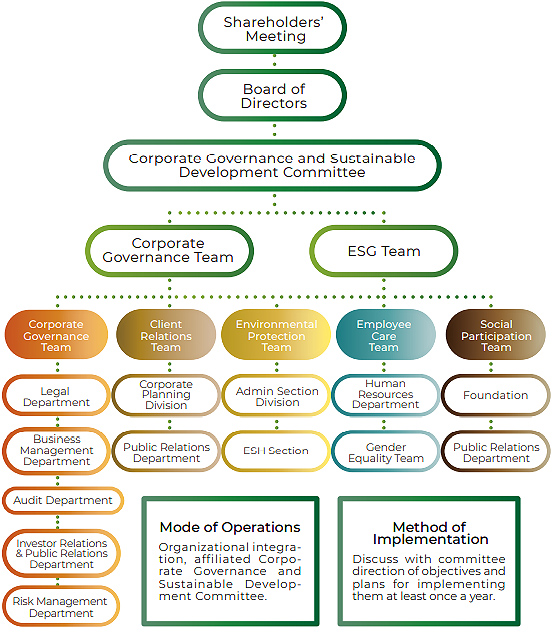

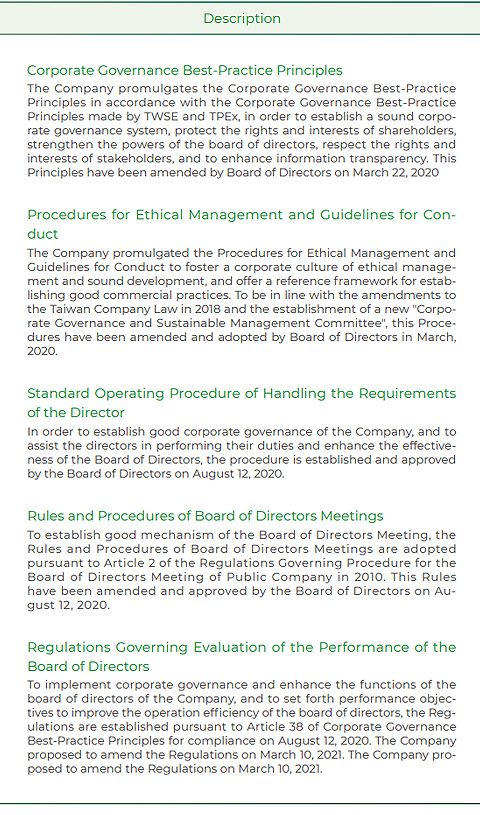

In 2018, Chailease created the dedicated position of Corporate Governance Officer. At the same time, the Chailease Holding Legal Department, Secretarial Office, and Administrative Department duties were adjusted. Corporate governance employees in the Secretarial Office and Administrative Department, in matters of corporate governance, are under the jurisdiction of the Legal Department. The Corporate Governance Officer oversees the Legal Department as it implements corporate governance. In addition to statutory corporate governance, the Corporate Governance Officer also coordinates the company’s legal affairs. The results of self-inspection in 2020 are in compliance with the laws and regulations.

In response to revisions to the scope of Taiwan’s Money Laundering Control Act, which added financial leasing activities, the company will undertake to implement all legal requirements and procedures required of financial leasing companies. Chailease will do our utmost to coordinate with competent authorities. While fulfilling our corporate social responsibility, combating money laundering and terrorist financing, and minimizing costs, we will assist the Taipei Leasing Association to work with the competent authorities and consultants to complete the questionnaire and create a template.

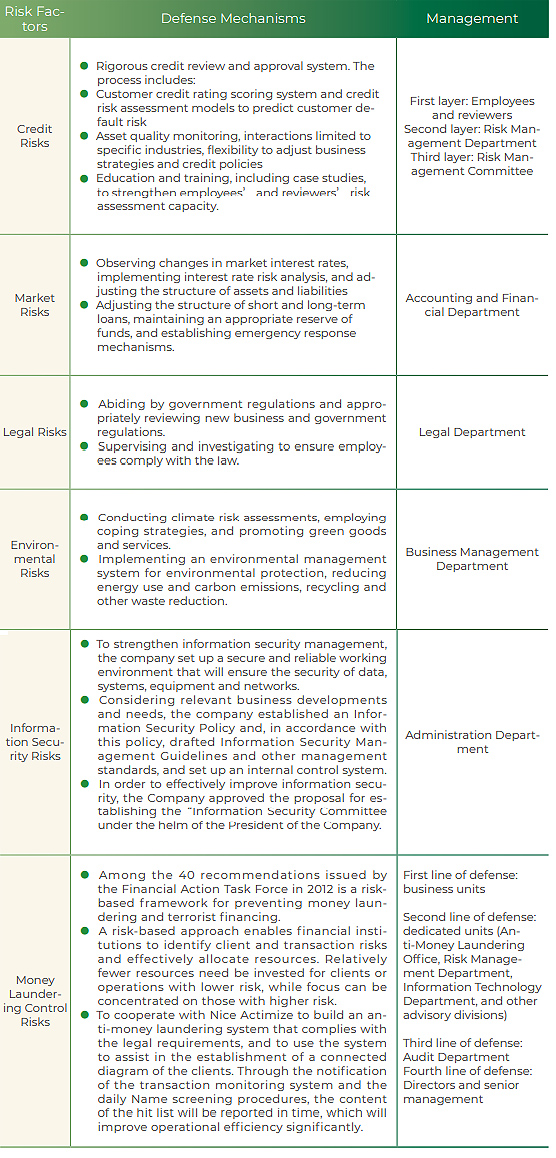

Due to the addition of financial leasing activities to the scope of Taiwan’s Money Laundering Control Act, Chailease and our key subsidiaries have established the below policy to prevent money laundering and terrorist financing:

- 1. In the revised portion of the internal regulations, the “Key Points for the Assessment of Anti-Money Laundering and Anti-Terrorism Operations” were added, and the “Anti-Money Laundering and Anti-Terrorism Programs” were integrated, so that front-line colleagues can more effectively check money laundering prevention related matters. In addition, the Company’s subsidiaries Chailease Finance Co., Ltd. and Fina Finance & Trading Co., Ltd. also revised the “Third Party Compensation Method” to simplify the process of verification and write-off of delayed cases by legal units.

- 2. Starting from 2020, the Company has incorporated the results of money laundering prevention into the KPI projects of business and review units to ensure the effective implementation of money laundering prevention operations.

- 3. Establishing an anti-money laundering management system, including an anti-money laundering management and customer basic information maintenance system which was purchase in mid-2019 and launched before the end of 2020.

- 4. In accordance with the “Implementation Measures for the Internal Control and Audit System for Preventing Money Laundering and Combating Capital Terrorism in the Handling of Financial Leasing Business Enterprises” issued by the Financial Supervisory Commission, the Company’s subsidiaries Chailease Finance Co., Ltd. and Fina Finance & Trading Co., Ltd. have completed the provision of “Institutional Risk Assessment Report” to the FSC for future reference.

- 5. According to the “Evaluation Points for Prevention of Money Laundering and Anti-Terrorism Operations” of the Company’s subsidiaries Chailease Finance Co., Ltd. and Fina Finance & Trading Co., Ltd., we do spot checks on business and review cases and promote according to the inspection results.

- 6. As of the end of December 2020, no suspected money laundering and terrorist transactions has been reported by the Company’s subsidiaries Chailease Finance Co., Ltd. and Fina Finance & Trading Co., Ltd.

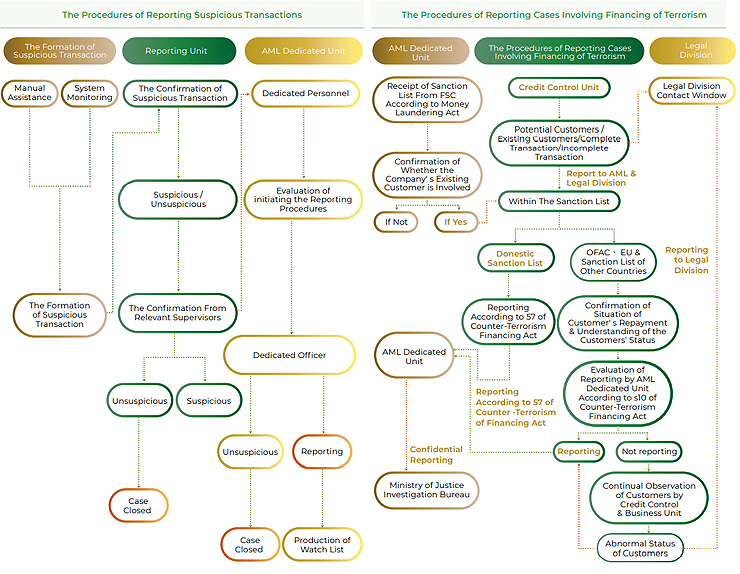

Money Laundering Prevention Production Process

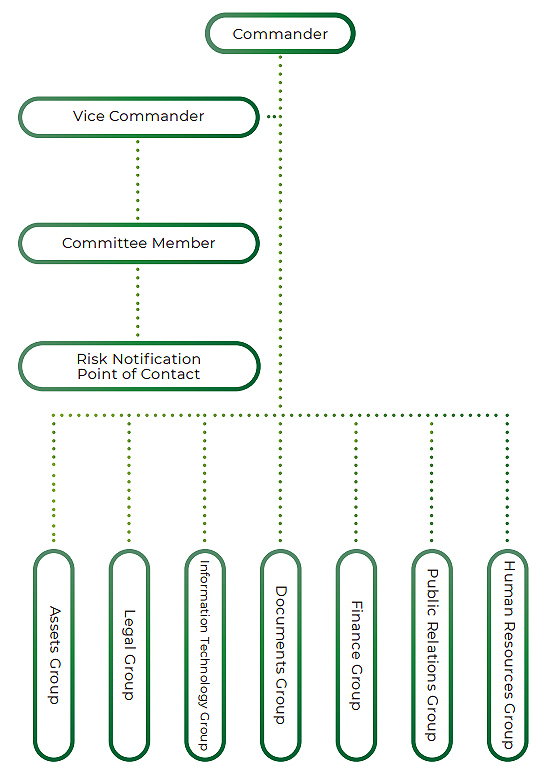

The AML/CFT management mechanism and continuous improvement aspects of the subsidiaries under the holding can be roughly divided into the following six aspects, including: institutional risk assessment, policies and procedures, customer due diligence, name checks, education and training, suspicious transactions/terrorist transaction reporting. Concrete actions are explained below:

The process management mechanism of the money laundering prevention manufacturing industry is explained as follows:

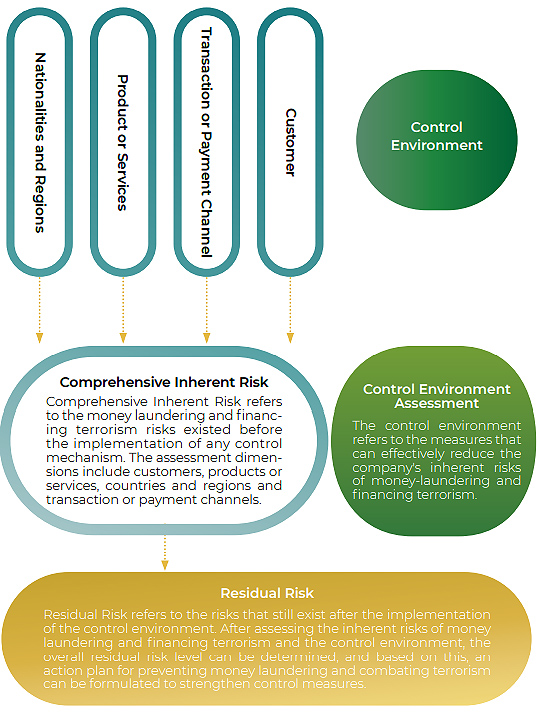

1. Institutional Risk Assessment Report (IRA)

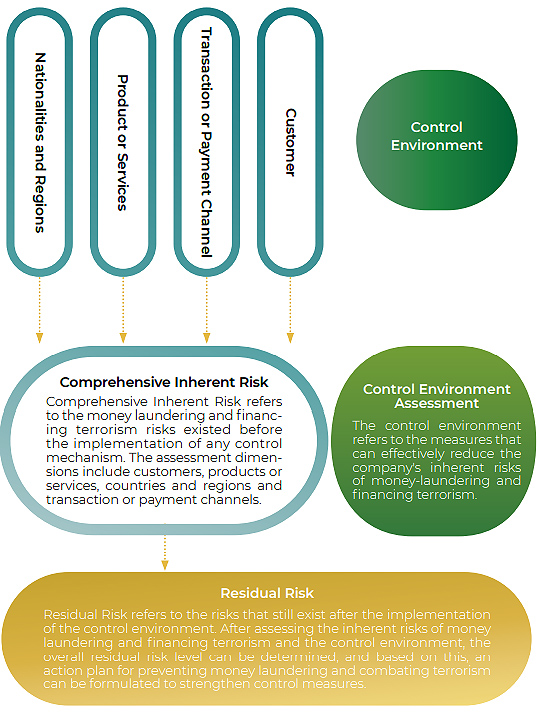

In order to timely and effectively inform the management team of the Company’s overall money laundering and capital terrorism risks and to determine and develop the mechanisms that should be established and appropriate mitigation measures that should be taken, the Company refers to the FATF40 recommendations, and in accordance with international norms and trends, by introducing the Group’s consistent institutional risk assessment methodology through consultants to conduct institutional money laundering and capital terrorism risk assessments. The assessment targets include countries and regions, products and services, transaction and payment channels, and customer aspects, assessing inherent risks, control measures and residual risks of the overall organization, understanding its own risks and formulating action plans (items to be improved) based on the report results. The corporate risk assessment report should be submitted to the board of directors and then reported to the competent authority for review. In addition, the action plan (items to be improved) in the corporate risk assessment report should be reported to the board of directors on a regular basis to track its implementation effectiveness. The board of directors also makes suggestions or provides certain support based on specific facts, and establishes a culture of the board of directors focused on money laundering prevention and combating capital terrorism.

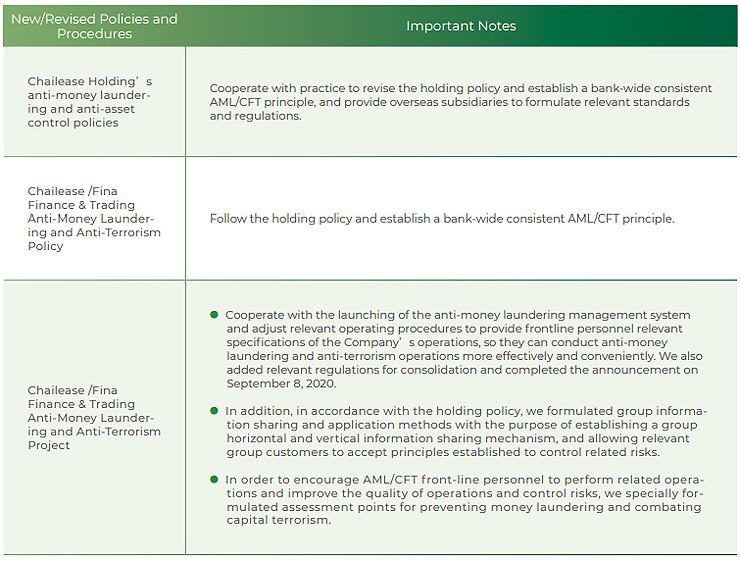

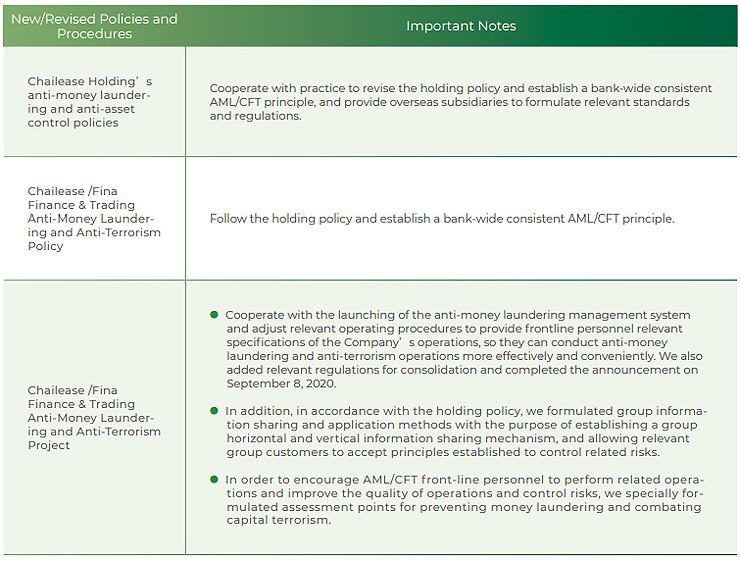

2. Policies and Procedures

In order to comply with external regulations, such as the Money Laundering Prevention Law, the Capital Terrorism Prevention Law, and the Measures for the Prevention of Money Laundering by Financial Institutions, new internal regulations and amendments were established in 2020. The adjustments made to important regulations are listed below:

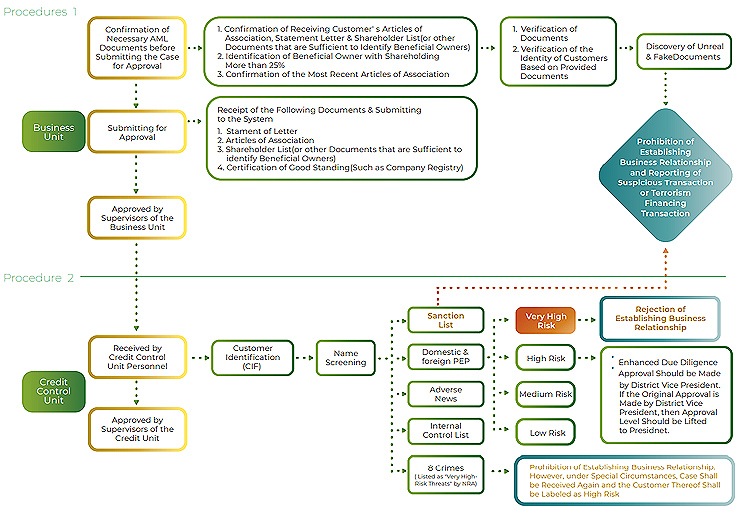

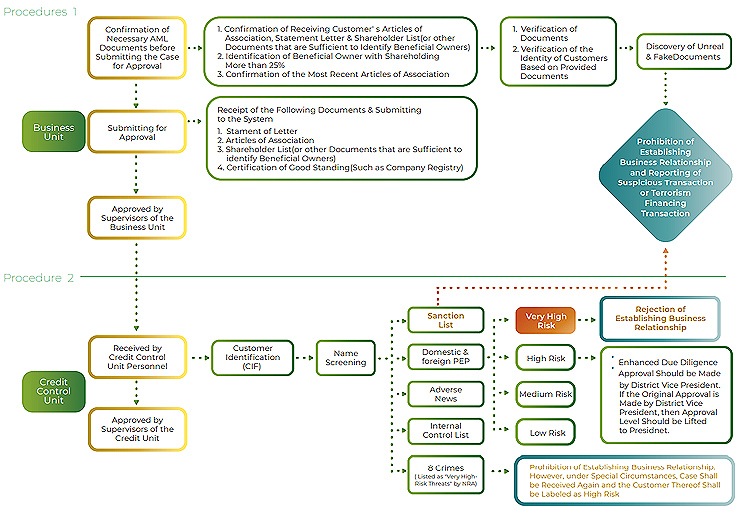

3. Customer Due Diligence

Measures are taken to identify customers, including collecting, updating, and storing information. These procedures include identifying the actual beneficiaries of business households and those with family members and close relationships with people with important political positions. We have adopted the principles of risk-based approach (RBA), review on a risk-based basis, focus on major money laundering high-risk customers and transactions with risk grading, and implement different intensity review mechanisms (CDD, EDD) to effectively allocate resources, such as identifying high risks customers’ needs to take enhanced due diligence to confirm their funding needs and main sources of repayment, and the establishment of business relationships with high-risk customers requires review and approval by senior management.

AML & CFT Procedures of Confirming the Identity of Customers

4. Name Check

When establishing a business relationship, the Company is to perform name checking operations on customers and persons related to them (person in charge, guarantee company/person, substantial beneficiary, and supplier). The name check database (Dow Jones database) is divided into domestic categories list of foreign sanctions (including but not limited to the sanctions lists published by the Office of Overseas Assets Control (OFAC) of the U.S. Department of the Treasury, the United Nations, the European Union, and China), people in important political positions at home and abroad, their family members, and people with close relationships (hereinafter referred to as Domestic and foreign PEPs) and negative news related to money laundering. If the database is updated, all customers will be checked on the incremental list in night batches every day. Whether it is the establishment of a business relationship or the batch name checking, the list information will be reviewed and released by the operator. If it is a sanction list, no business relationship is to be established and should be notified immediately. If it is domestic and foreign PEPs, the customer risk should be raised to a high-risk customer, and regular review operations are to be performed every year. If it is involved in negative money laundering news, it should be confirmed whether it is a very high-threat eight crimes in the National Risk Assessment Report (NRA) If so, it should be strengthened to confirm the use of funds and the source of repayment, and it can only be undertaken after approval by senior management. In addition, the Company has also established a group self-built list sharing mechanism, and when a business relationship is established or a self-built list is added, the list will be checked.

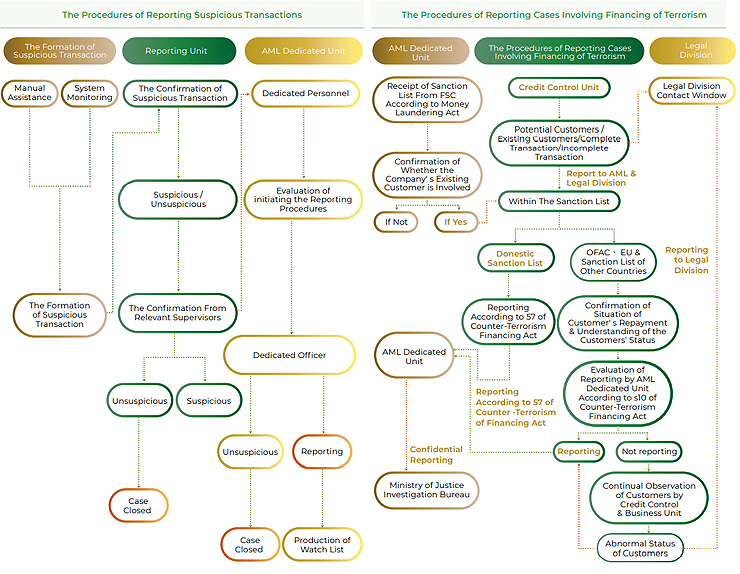

5. Suspicious Transaction or Terrorist Transaction Detection and Report

Regarding transaction monitoring, when conducting transactions or establishing business relationships, dedicated personnel will analyze and collect data on potential high-risk customer alerts in a risk-based spirit, referring to customer industries, channel sources, business departments, and transaction activities whether it conforms to past habits, keep a record of the investigation process, and implement strengthened control measures, improve the level of transaction approval and strengthen due diligence. After investigation and analysis, the dedicated staff will submit suspicious activity reports to the Ministry of Justice Investigation Bureau of the clients or transaction activities that may be involved in money laundering or terrorist activities. Since the outsourcing system was launched in December 2020, relevant alarm cases have been collected and the dedicated unit has taken advantage of the subsequent control of related risks in addition to the future plans and measures of money laundering.

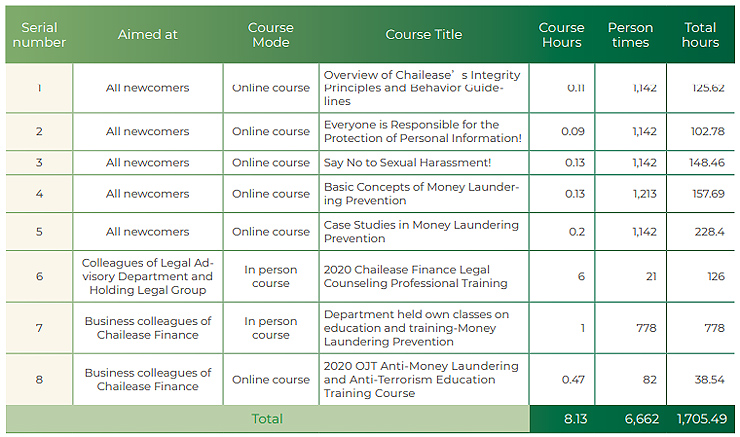

6. Education and Training

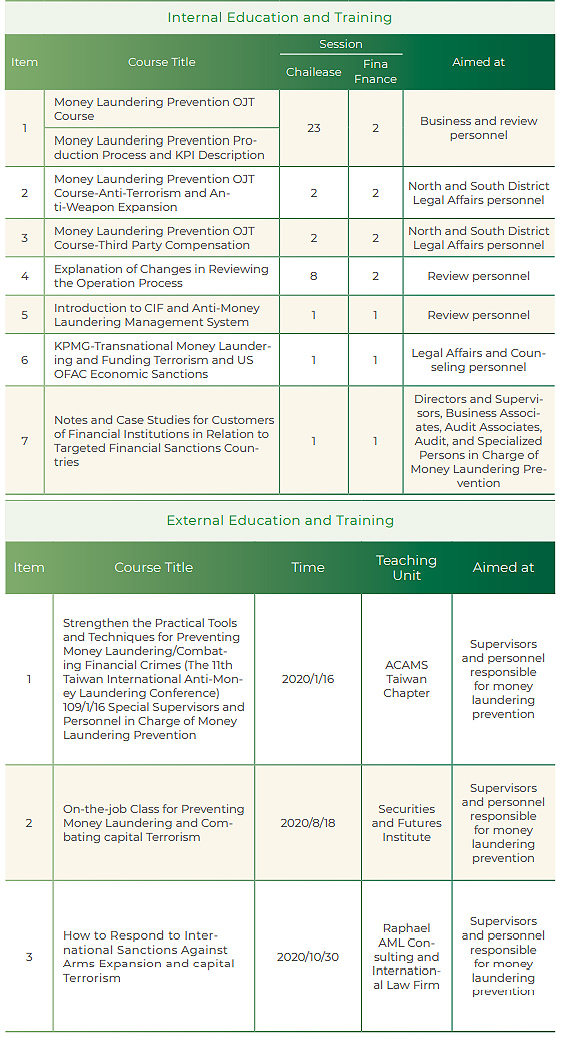

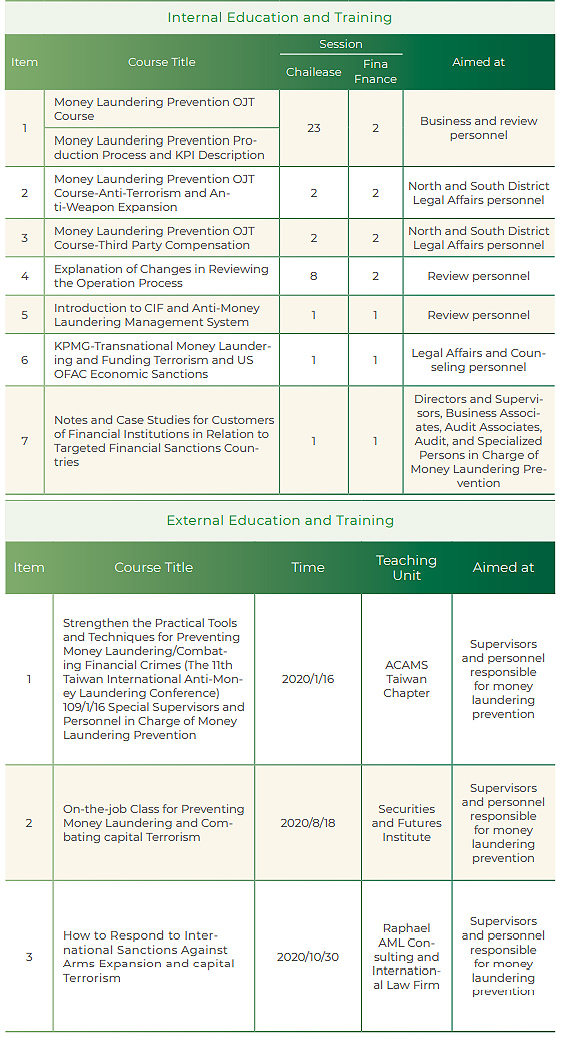

In order to strengthen money laundering prevention and anti-capital terrorism education training courses and deepen the awareness of all personnel to prevent money laundering, each year, all colleagues (including new recruits), dedicated personnel, directors and senior management personnel, legal compliance, auditing and first-line business are divided into categories according to the nature of their business to arrange appropriate education and training for the prevention of money laundering and anti-capital terrorism.

In addition, dedicated supervisors have obtained internationally recognized anti-money laundering specialist (CAMS) licenses and regularly receive relevant training in the courses (including online training) held by internationally recognized anti-money laundering specialists. In response to international trends and changes in laws and regulations, understanding the most money laundering prevention and anti-terrorism operations and making adjustments accordingly. Relevant education and training are as follows:

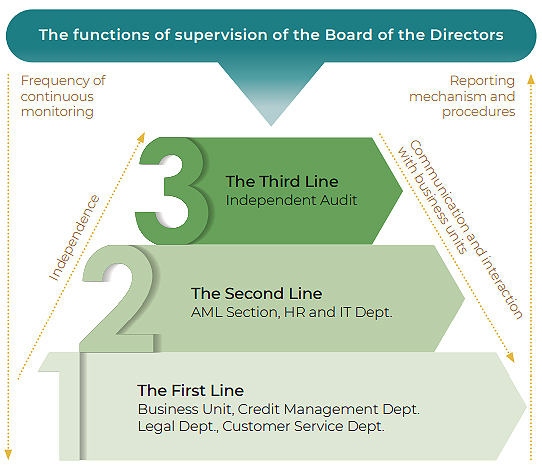

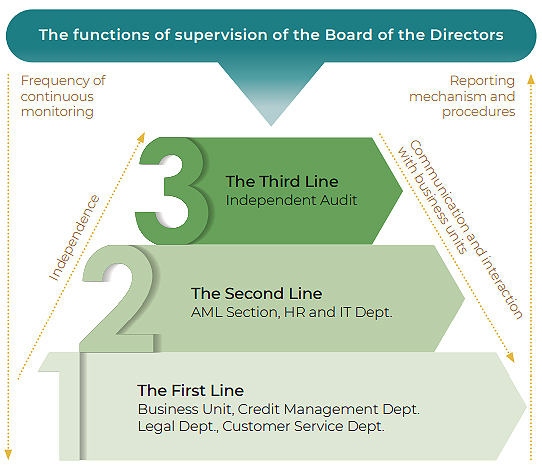

7. Independent Audit and Review System

The audit unit conducts effectiveness tests on the three major areas of personnel control (organization), policies, operating standards, and money laundering prevention system every year, issues an audit report to the board of directors, and regularly tracks the improvement of each unit in response to the audit results.

8. Regularly Report AML/CFT Execution Business Reports

The dedicated unit shall report to the board of directors and supervisors an overview of the implementation of money laundering prevention and anti-terrorism operations every year. The annual report shall at least cover changes in laws and regulations, operation execution overviews and reports on important implementation projects of the current year. If a major violation of money laundering prevention laws and regulations is found, it will be immediately reported to the board of directors and supervisors. Directors and supervisors are to discuss and give suggestions based on the content of the report. After the meeting, if there are matters that need to be improved and tracked, the money laundering prevention unit shall regularly report the improvement progress to the board of directors and supervisors to establish the Company’s complete system and culture of money laundering prevention and combating capital terrorism.